Master Financial Analysis Through Real Market Experience

Our comprehensive program combines theoretical foundations with hands-on practice using actual Australian market data. You'll work with current financial statements, analyze real investment opportunities, and develop skills that employers value.

Discuss Your Learning Path

Evidence-Based Learning Framework

We've spent three years refining our approach based on what actually works in Australian financial markets

Case Study Integration Method

Instead of theoretical exercises, you'll analyze actual companies like Telstra, Commonwealth Bank, and BHP. Each week focuses on a different sector, giving you exposure to various financial patterns and business models.

Progressive Complexity Building

Month one covers ratio analysis basics. By month six, you're building complex discounted cash flow models and conducting peer comparisons. Each skill builds naturally on the previous one.

Measurable Learning Outcomes

We track specific competencies rather than just completion rates. Here's what our 2024 cohort achieved:

Students who can independently analyze a 10-stock portfolio within 4 hours by program completion

Average time for students to progress from basic ratios to complex valuation modeling

Students who successfully complete real company analysis project using ASX-listed companies

Average increase in financial statement analysis speed from start to finish

Typical Learning Progression

Foundation Building

Master ratio analysis and basic financial statement interpretation using real ASX companies

Advanced Modeling

Build DCF models and conduct peer comparisons across different industry sectors

Portfolio Integration

Analyze complete portfolios and present investment recommendations with confidence

Find Your Learning Path

Everyone starts from a different place. Let's figure out which approach works best for your current situation and goals.

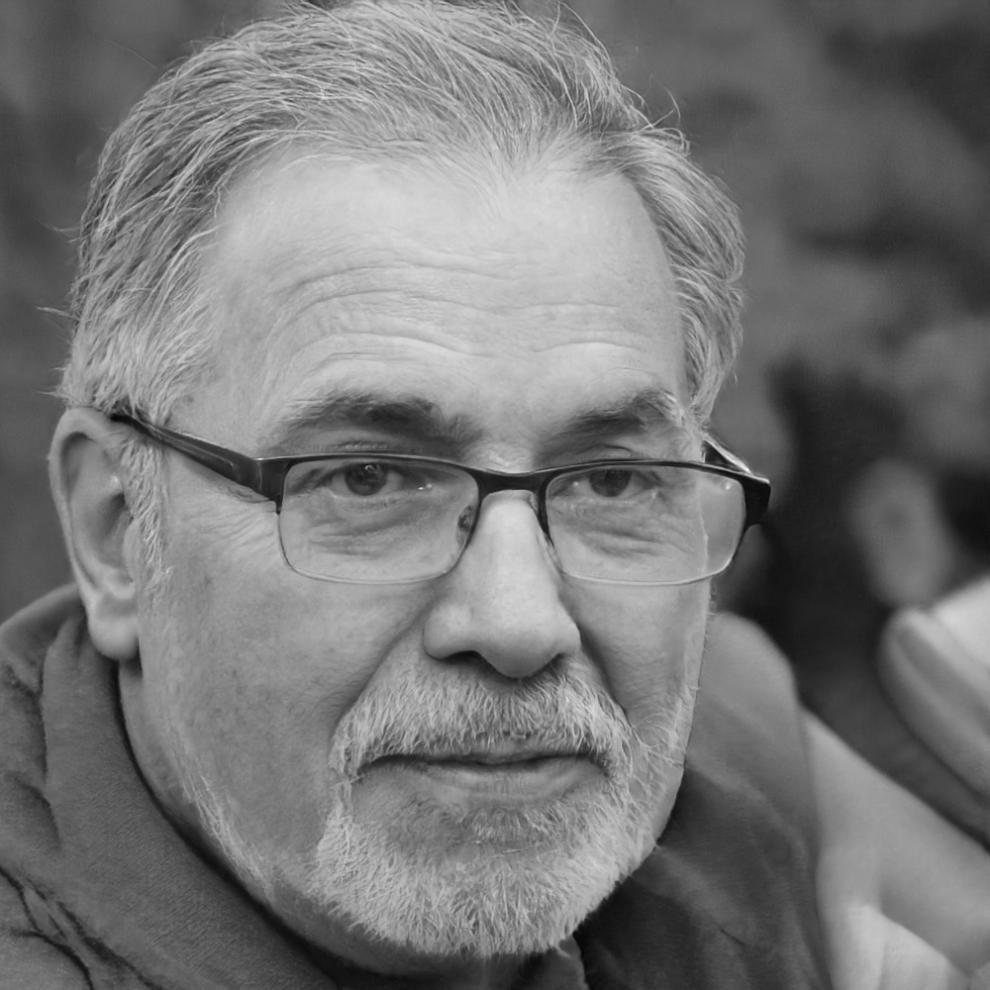

Marcus Chen

Lead Program Advisor

Recommended Learning Tracks

Next Cohort Begins September 2025

We're accepting applications now for our autumn intake. Class sizes are limited to ensure everyone gets individual attention during the practical exercises.